Recent Blogs

Your Guide to Buying an Electric Surfboard

April 9, 2024

Our Favorite Inflatable Docks & Floating Cabanas

February 19, 2024

Understanding Boat Trade in Values

February 19, 2024

Archives

Categories

- Everything Else (30)

- Apparel (9)

- Boating (201)

- Boat Show (5)

- Yacht Tenders (13)

- Charity (1)

- SUP (10)

- Customer Service (1)

- Yacht Toys (9)

- Events (3)

- Places (1)

- Fishing (30)

- Kayak Modding (1)

- Marine Training (1)

- Land Toys (0)

- Watersports (2)

- Amphibious (1)

- Toys (5)

- Submersible (1)

- Propane Gas Engines (2)

- Kayak Fishing (6)

- Diving (1)

- Docks (2)

- Boat Accessories (4)

- Safety (3)

- Kayaking (14)

- New products (3)

- Boat Service (2)

- Engines (34)

- Sailing (1)

- Yacht Brokerage (1)

- Brokerage (2)

- Kayak (1)

Understanding Boat Taxes: Tax Breaks & Deductions

The idea of having your own boat is appealing for many reasons, and a variety of available tax breaks makes it even better. A boat is generally considered to be an “entertainment facility” in the eyes of the IRS, and expenses that arise from that enjoyment of a boat are not deductible on taxes. Such expenses might include things like depreciation and operating costs such as rent, utilities, maintenance, and protection. That said, there are still multiple tax breaks boat owners might be eligible for depending on how the boat is used.

Boats for Business

If you use the boat in relation to your business, you may be able to deduct some of the costs associated with your outing. Travel and entertainment deductions are limited to 50% of that cost. Those costs may include things like fuel, food drinks, or transient mooring. It’s important to document the outing and expenses thoroughly, taking note of information like the date, location, and reason for the outing as well as the names and occupations of everyone who joins you.

You should be able to demonstrate that you were using the boat to entertain clients. Furthermore, you need to have a reasonable expectation that you will achieve revenue as a result of your outing on the boat, and you must discuss business during the outing. You may also be able to claim a home office deduction if you work from your boat, though that normally doesn’t apply. If you have questions about whether or not your boating-related expenses may qualify you for a tax deduction, it is wise to talk to an accountant for guidance.

Boats as Business

If your boat is an especially integral part of your business, you may be eligible for greater deductions. For example, you may be able to write off some of your costs if you charter your boat and act as the captain. In this scenario, you must have a U.S. Coast Guard license to take six paying passengers on your boat. You may also have to insure your boat for commercial use, and you’ll have to be able to demonstrate that you’re attempting to make a profit. That is, you will not be eligible for tax deductions if you’re simply chartering your boat as a hobby.

Charter ownership allows boat and yacht owners to deduct things like boat depreciation, fuel costs, maintenance fees, mooring costs, and some equipment. If you treat your boat or yacht as a charter, you’ll need to keep detailed records of all income and expenses, just as you would with other business assets. You cannot write off expenses when you use the boat for pleasure, even if you use it as a charter at other times. The IRS may start to pay special attention to your listed deductions if you regularly fail to report making a profit over the course of a year.

Boats for Transportation

If you regularly use your boat for business-related transportation, you may be eligible for a deduction. To qualify, you’d have to be using your boat for business transportation at least 50% of the time. This would allow you to deduct things like insurance, repairs, dock fees, crew salaries, storage, fuel costs, and depreciation. If you use the boat for client entertainment though, you will likely nullify any ability to claim it as a listed property for transportation deductions.

Donating Your Boat

In some cases, boat owners elect to donate their boat to a non-profit organization instead of selling it. Donating a boat might make you eligible for a donation of the fair market value of the vessel. To determine the fair market value, you’ll have to have an appraisal in the form of a survey. You can write off the fair market value of the boat if the charity ends up using the vessel in conjunction with their work. If the non-profit sells your donated boat, you’ll be able to claim a deduction for the amount the boat sold for instead of the appraised value.

One of the nice things about donating a boat to a non-profit instead of selling it is that the process is often fast and easy. Many charities that accept donations of boats are prepared to take care of the paperwork for you. They’ll give you tax forms for accounting purposes, which can make things easier when it comes time to do your taxes. You may also be able to donate your boat more quickly than you could find a buyer.

Boat as a Home

Declaring your boat as a second home is one of the ways you can get the biggest tax deduction for boat owners, especially when it comes to recreational boating. Your boat will have to have a kitchen or other cooking capabilities, a place to sleep, and a toilet (even if the toilet is portable). If you already have a second home, you won’t be able to get a deduction for your boat because the IRS doesn’t give deductions for third homes.

If you rent your boat out to others throughout the year, you’ll have to stay on the boat 10% as many days as it’s rented, or at least 14 nights per year. If your boat qualifies as a second home, you can get a 1098 form from the lender to help you report the interest as a tax deduction.

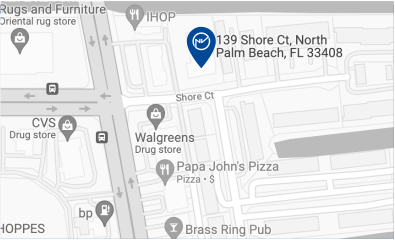

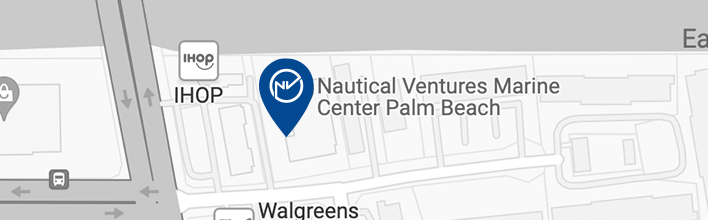

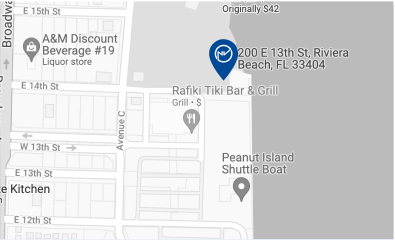

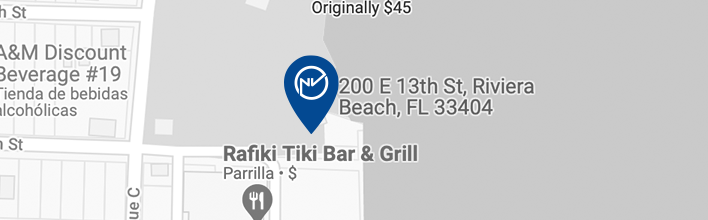

Nautical Ventures Marine Center in Florida

Here at Nautical Ventures Marine Center, we have everything you need for your boating journey. We can help you buy, care for, or sell a boat thanks to our large selection and extensive list of services. Florida residents can count on us for engines, tenders, and a wide variety of different toys to enjoy on the water. Visit us in Broward, Tampa Bay, Palm Beach, or Sarasota. Alternatively, we invite you to reach out to us online if you have any questions. Call (954) 926-5250.

Image Credit: Shutterstock / MJTH

Sign up for Nautical Ventures EMAIL UPDATES & PROMOTIONS

Comments